The latest analysis of the PC DRAM market from DRAMeXchange, a division of TrendForce, finds that most contracts are now monthly deals rather than quarterly deals, with February even seeing a most unusual, large down-correction in prices. The current quarterly decline dropped from the originally projected 25% to nearly 30%, resulting in the sharpest decline in a single season since 2011.

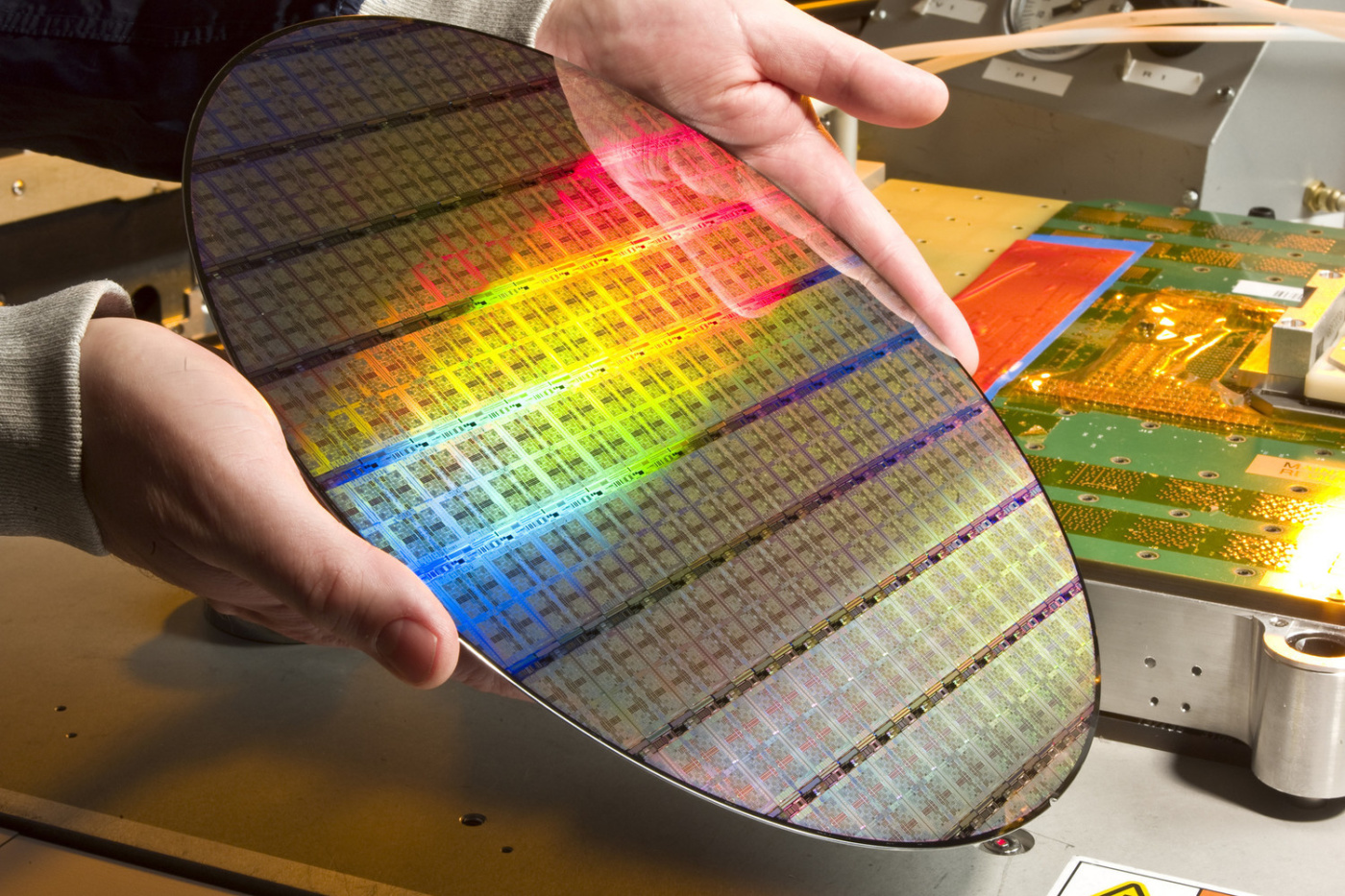

DRAMeXchange points out that, according to the most recent market observations, inventory levels have kept climbing ever since overall contract prices dropped in the fourth quarter of last year, and most DRAM suppliers are currently holding around a whopping six weeks’ worth of inventory (wafer banks included). Meanwhile, Intel’s low-end CPU supply shortage is expected to last until the end of 3Q19, and PC-OEMs are unable to carry out the consumption of DRAM chips under demand suppression. The overall market has thus entered freefall, meaning that large reductions in prices aren’t going to be effective in driving sales. The excessively high inventory will continue to cause down-corrections in prices this year if demand doesn’t make a strong comeback.

Looking at the DRAM market one or two years into the future, the big trio aren’t going to roll over in the competition for market shares any time soon. SK Hynix has recently announced that it will invest 120 trillion won (around US$107 billion ) to build four new wafer fabs as part of its strategy to improve its competitiveness. Micron, on the other hand, doubled down and commenced construction of an IC testing and packaging plant in Taiwan. At the same time, its subsidiary Micron Memory Taiwan ( formerly Rexchip) in Houli, Taichung, is considering building a new 12-inch DRAM wafer fab, which could finish construction as early as the end of next year, and massively contribute to production in 2021. As for the world’s largest DRAM supplier Samsung, it is currently building a second fab at Pyeongtaek.

“The rich stay rich”-such is the immutable trend of the DRAM market; furthermore, new competitors are aided by a wealth of resources and capital upon entering the market. Hence, if smaller DRAM suppliers don’t find ways to catch up on production processes and scale, they may risk being marginalized in the near future.

Via TrendForce